Frontiers | Evaluating Credit Counterparty Risk of American Options via Monte Carlo Methods: A Comparison of Tilley Bundling and Longstaff-Schwartz LSM

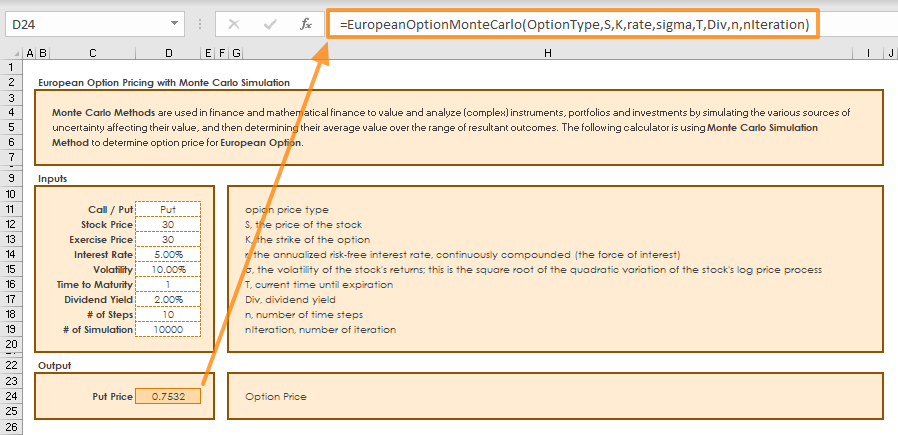

Option Pricing using Monte Carlo Simulation - Pricing Exotic & Vanilla Options in Excel - Introduction - FinanceTrainingCourse.com

SciELO - Brasil - Valuation of american interest rate options by the least-squares Monte Carlo method Valuation of american interest rate options by the least-squares Monte Carlo method